Prevention is a crucial part of maintaining excellent oral health. Our nearby dentist can provide the vital support your teeth need.

MetLife Dentist – Shorewood, WI

Learn More About the Benefits of MetLife

Did you know your oral and general health are closely connected? Routine dental care keeps common issues at bay to support a healthy mouth and body. If you pay monthly premiums for dental insurance, you can benefit from affordable dentistry to keep your teeth and gums healthy. By choosing a MetLife dentist in Shorewood, you'll enjoy discounted rates for the services you need to protect your smile. At Shorewood Family Dentistry, we will help you achieve your best smile for minimal out-of-pocket costs.

MetLife Coverage Availability & Fees

Dental insurance is designed to prevent common oral health problems from occurring in the first place, like cavities and gum disease. Paying your premiums gives you access to a variety of services to preserve your natural smile. If a complication occurs, MetLife will cover a portion of the cost. While every policy differs, most plans include:

- 100% of preventive services

- 80% of minor restorative services

- 50% of major restorative services

You can visit your dentist every 6 months for a cleaning and checkup after a co-payment using your dental insurance. Research has found that every $1 spent on prevention can save up to $50 on restorative fees. Not to mention, you significantly lower your risk of a dental emergency.

If your dentist finds anything concerning or a problem occurs between your regular appointments, you don't have to wait to get the care you need. After meeting your annual deductible, you can use your yearly allowance to pay a portion of the cost of common restorative treatments, like fillings, root canals, and dental crowns.

MetLife recommends choosing a dentist in their network to enjoy more coverage at the time of services. An in-network dentist has pre-negotiated rates for specific treatments to keep dentistry affordable. You can still use your insurance at an out-of-network dentist. You'll have to pay the difference between your insurance's allowable amount and the dentist's fees. Our office is proud to work with both in-network and out-of-network patients.

Unfortunately, your dental coverage doesn't last forever. It resets at the end of the year, and you'll lose anything you don't use. You won't be reimbursed for your premiums or deductibles. Nothing will carry over for accumulation, either. With less than 3% of Americans reaching their annual limits, we don't want to see you throw money down the drain. We know dental insurance can be confusing, but we are here to help.

MetLife Employers in Shorewood

Most often, MetLife patients get coverage through their job. Although other companies may offer MetLife dental benefits, the main employers in the area that provide these insurance plans include General Electric, General Electric Healthcare, and Manpower Group. If you work at any of these companies, you should have a human resources department who can also answer questions about your coverage, but feel free to turn to our experts here at Shorewood Family Dentistry as well.

Maximize Your Dental Insurance

A member of our team will work on your behalf with your dental insurance to handle all the paperwork, so you have one last thing to worry about. They will explain how your coverage is being used and if you owe any out-of-pocket expenses. They will review your payment options, like traditional methods or monthly installments through a third-party financing company.

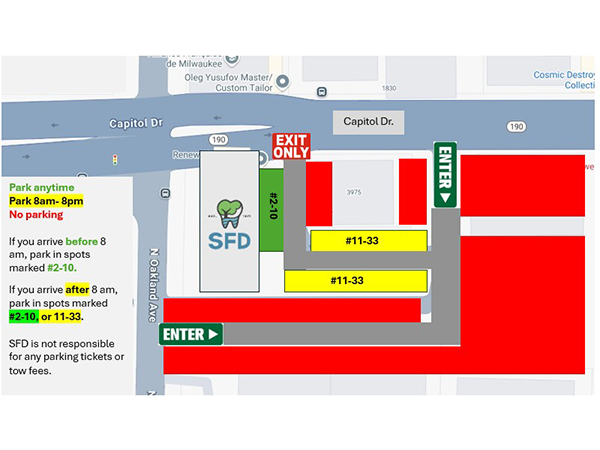

Dental insurance in Shorewood is an investment in a healthy smile. If you have questions about your coverage, or you need to schedule an appointment, call (414) 775-3112.